Against nihilism

We live in a time of cynicism about what government can accomplish. Most Americans say they don’t have much trust in Washington, regardless of which party is in charge. Even when the federal government sets out to do something that Americans support, many wonder whether it can succeed.In today’s newsletter, I want to connect four news stories from the past few years and argue that this cynicism has gone too far — that government can indeed accomplish what it promises. I recognize some readers will support the policies I describe, while others will oppose them. But that’s OK. I’m not trying to persuade you that these policies are good or bad.

The point instead is that the U.S. federal government remains a powerful force that can alter the course of American life. The country has the capacity to address its biggest problems. Whether it does is a different matter.

1. The Covid vaccine

The pandemic was so miserable and divisive that it can be easy to overlook the triumph of the federal government’s vaccine development. Before Covid, the creation of any new vaccine took years. But Operation Warp Speed — a public-private partnership that received $18 billion in federal funding — led to the discovery of a Covid vaccine within months. That speed likely saved millions of lives worldwide.Yes, the pandemic was also a case study of government failure. Republican politicians (including Donald Trump, who deserves some credit for Warp Speed) refused to embrace the vaccines, leading to hesitancy that cost lives. And many Democratic-run school districts shut down for a year or longer, causing lasting damage to children.

All of this, though, was a reminder of the power of government, for good and ill.

2. Immigration

In the debate over immigration, you sometimes hear the suggestion that the U.S. is powerless to change migration flows. “Border Enforcement Won’t Solve the U.S. Migrant Crisis,” as a typical op-ed argued in 2022. One way or another, according to this argument, people will find ways to enter the U.S.But that argument is mostly wrong, as the past four years show.

President Biden took office promising a more welcoming approach to immigration than any president in decades. Sure enough, immigration surged. During the first three years of Biden’s administration, annual net immigration (the number of people arriving, regardless of legal status, minus the number of immigrants leaving) averaged 2.4 million, according to the Congressional Budget Office. That’s about three times as high as during Trump’s presidency. It’s more than twice as high as under Barack Obama.

Late last year, Biden changed course. The administration first worked with Mexico to reduce migration flows and then tightened border policies, as my colleague Hamed Aleaziz has explained. Almost as quickly as immigration spiked in 2021, it has fallen in 2024:

[td]

[/td]

[/td]

[td width="600px"][/td]

Source: U.S. Customs and Border Protection | by The New York Times

3. Economic policy

Biden’s economic record is obviously mixed. But he made a set of specific promises about using the federal government to rebuild infrastructure, reduce medical costs, promote clean energy and expand certain kinds of manufacturing. In each of these cases, it’s happening.New semiconductor factories are being built in Arizona, Missouri, Texas and elsewhere. Roads and bridges are being rebuilt. The cost of insulin has plunged for many people. Clean energy production has increased.

Biden’s industrial policy has been a reminder of the vital role that the federal government has historically played in creating industries like aviation, biotechnology, fracking and the internet.

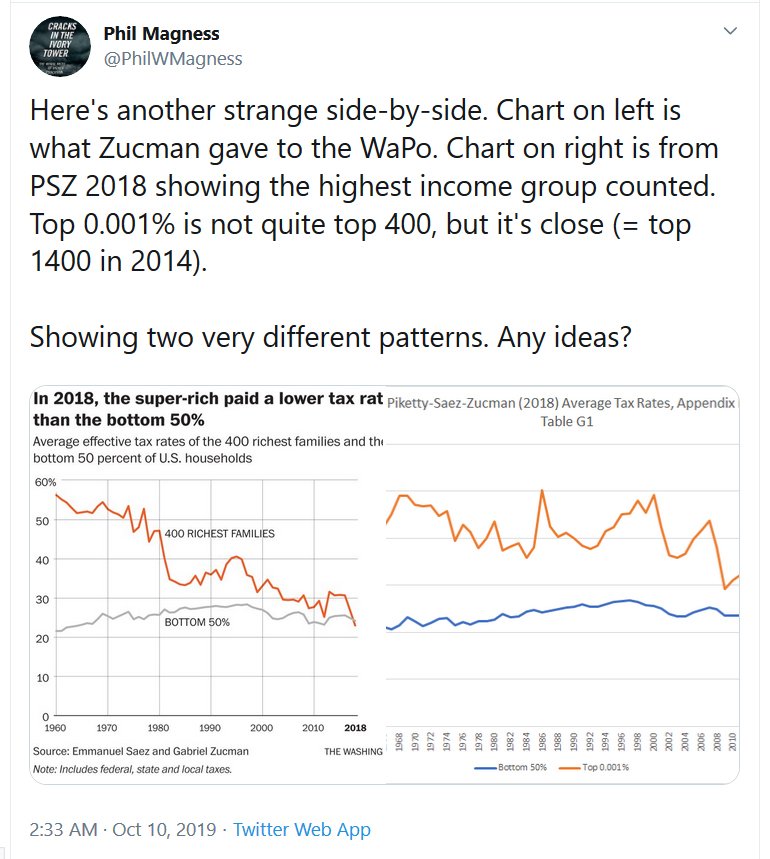

4. Taxes

As with immigration, you sometimes hear the claim that federal laws don’t much matter — and particularly that the wealthy can find ways to avoid any tax increases. That’s not correct.After Obama raised taxes on wealthy Americans, they paid more in taxes. After Bill Clinton raised income taxes at the start of his presidency, the same thing happened. And after Clinton later cut capital-gains taxes, tax payments fell.

[td]

[/td]

[/td]

[td width="600px"][/td]

Source: Emmanuel Saez and Gabriel Zucman | by The New York Times

The bottom line: The fact that governments remain powerful forces even in a globalized, digitized economy doesn’t answer many of the hard questions about what policymakers should do, of course. But it at least offers an antidote to the nihilism that sometimes dominates political debates.