I will answer these as I read them.The reason that long term gains are usually taxed at a more favorable rate than ordinary income is because someone was smart enough to realize that capital gains include inflation (which is government caused for the most part) so the longer you've held something the more its selling price has been impacted by inflation rather than true appreciation.

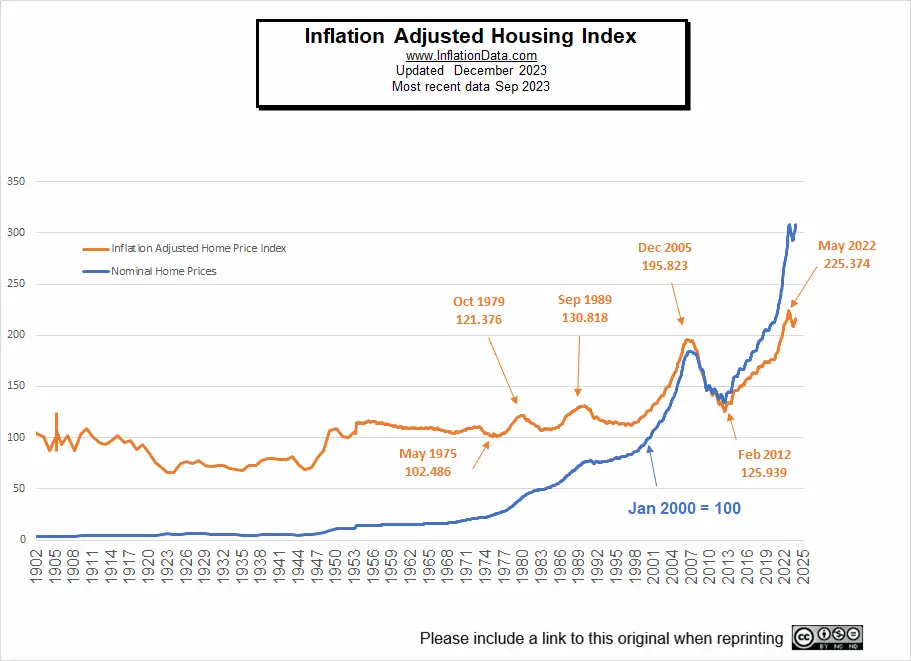

1. You are partially correct, Inflation does effect return on investment. Although, you can look at this chart and be able to tell that for the last 40 years inflation has not been a major factor.

Historical Inflation Rates: 1914-2026

The table displays historical inflation rates with annual figures from 1914 to the present. These inflation rates are calculated using the Consumer Price Index, which is published monthly by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor. The latest BLS data, covering...

In that time period, Increases in Real estate have been considerably greater than the inflation rate, negating your position on lowered capital gains taxes.

side bar: We already have a virtual lifetime deferment on our homestead capital gains so you probably don't need to add that point to your arsenal.

Adjusted for inflation to keep you from having to do the math

Inflation Adjusted Housing Prices

Inflation-Adjusted Housing Prices show that housing prices don't "always go up" giving an unbiased look w/o inflation clouding the picture.

So these two chart pretty much much show your statement to be mostly inaccurate.

As far as government creating inflation, I would like to hear your take on that.

Last edited: