hi i have a Dilemma and i am not sure which way to go

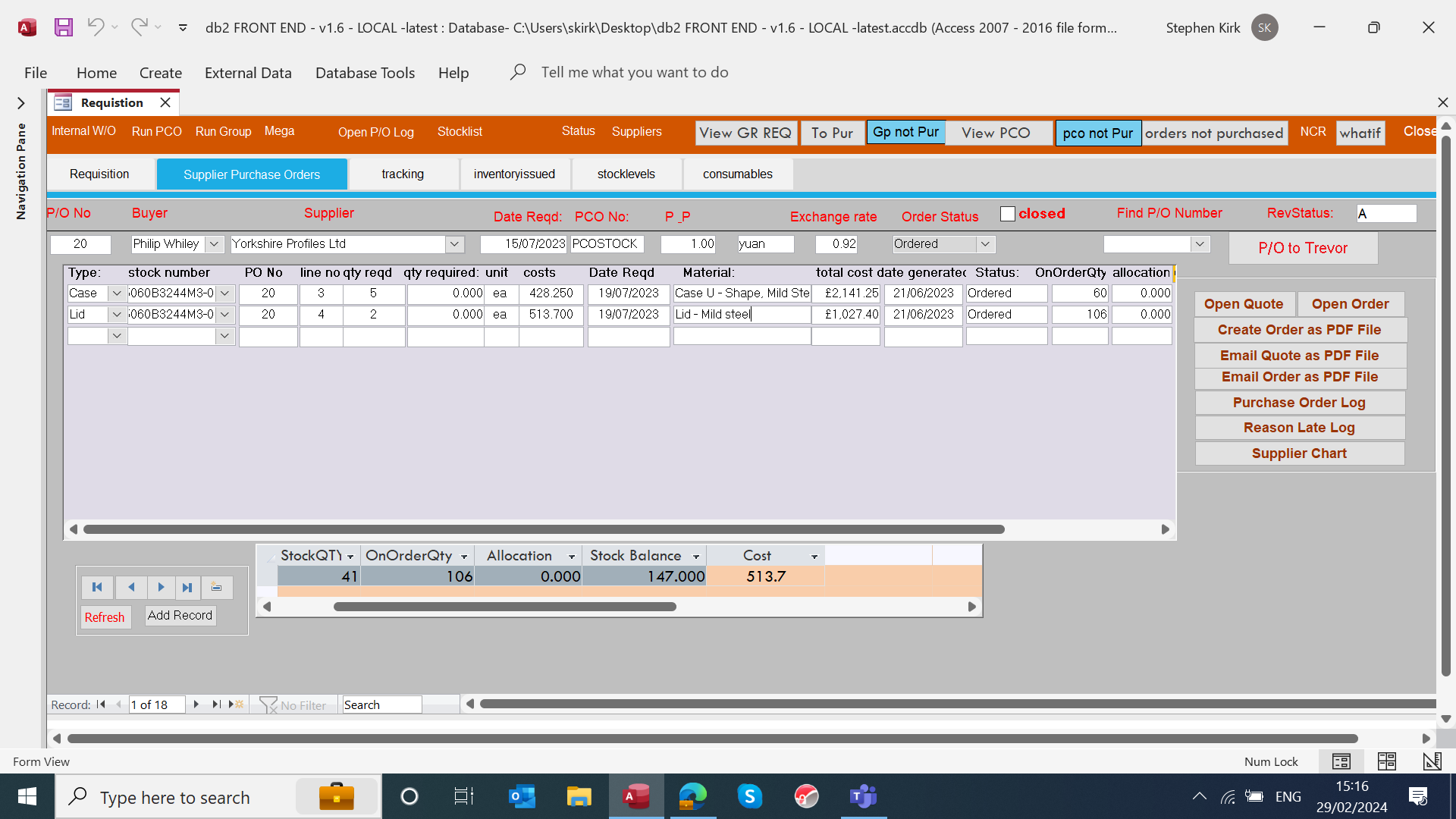

so lets say i have 3000 stock items sample below , anyone of these items could come from any country in the world . lets say the first 2 items i purchase from one supplier in england, the next 3 in europe and the last 5 in china

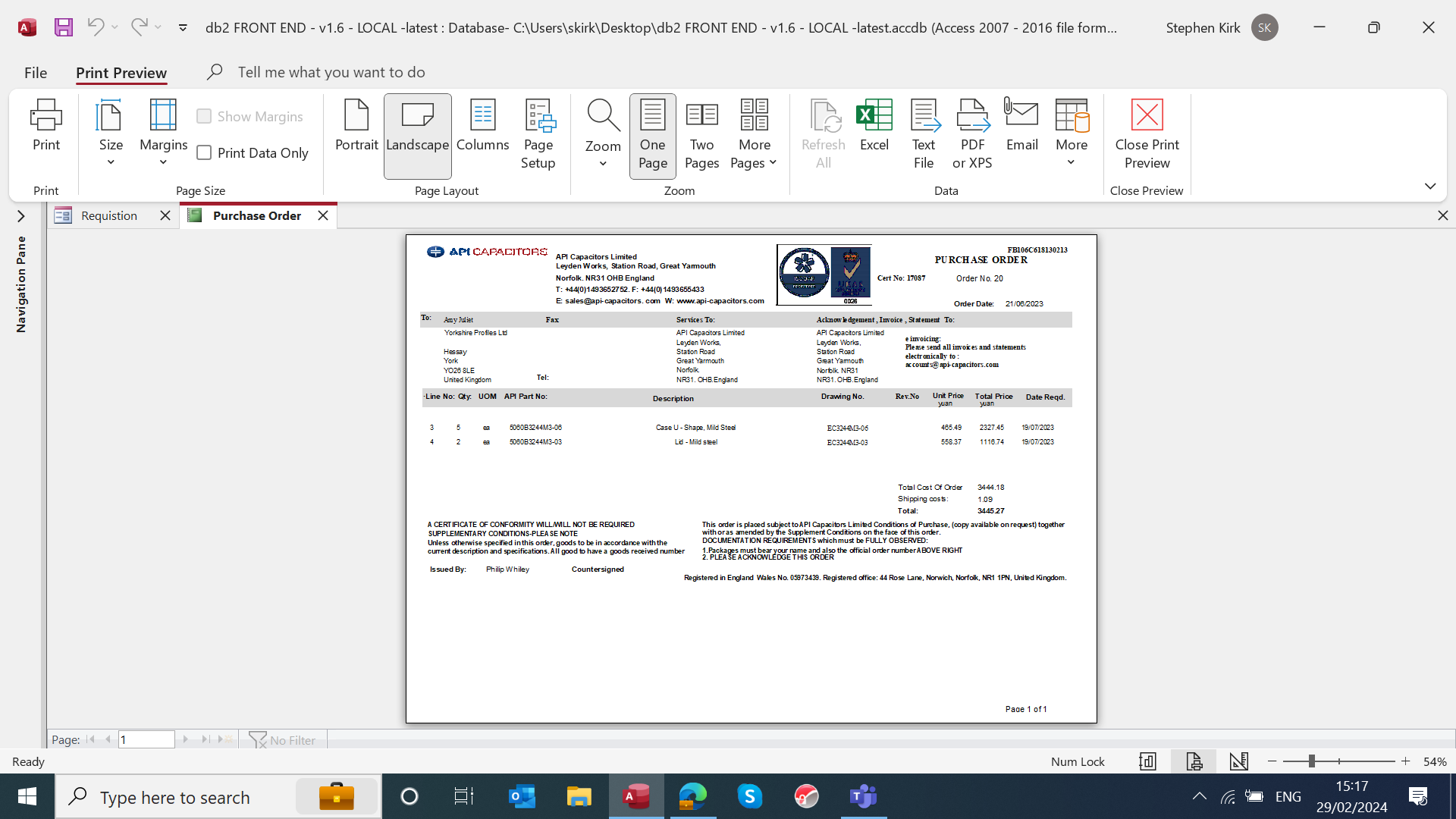

so i create a purchase order and the p/o I send to the supplier must be in the currency for that country but the form could have the information "cost" and "total" in pounds and i convert it for the p/o into the correct amount using the currency i look for on the internet . but this is trial and error to get the correct pounds value into the form

or i can just put the value in the correct currency and not worry about working out any other costs

the problem i then have is

how do i get a pounds total value of all the stock items when i do a stock take that are in the stock list as they are from all over the world and are different currency

thank steve

Stocklist Stocklist

Stocklist Stocklist

so lets say i have 3000 stock items sample below , anyone of these items could come from any country in the world . lets say the first 2 items i purchase from one supplier in england, the next 3 in europe and the last 5 in china

so i create a purchase order and the p/o I send to the supplier must be in the currency for that country but the form could have the information "cost" and "total" in pounds and i convert it for the p/o into the correct amount using the currency i look for on the internet . but this is trial and error to get the correct pounds value into the form

or i can just put the value in the correct currency and not worry about working out any other costs

the problem i then have is

how do i get a pounds total value of all the stock items when i do a stock take that are in the stock list as they are from all over the world and are different currency

thank steve

Stocklist Stocklist

| MaterialID | Type | StockNumber | Material | Cost |

|---|---|---|---|---|

1 | film.. | 7511038-01 | Film mPP 10.8 µm x 37.5 mm DEM 2.5 - High Isotactic | 24.89 |

2 | Foil | 7805018-01 | 5 µm x 18 mm aluminium foil | 41.32 |

3 | film.. | 7508125-01 | Film mPP 7.8 µm x 125 mm SEM 5.0 - High Isotactic | 17.35 |

4 | Solder | 1596B1240 | GS001 500gm 1.6 solder 60/40 KP GR400 | 23.5 |

5 | Wire | 3096B1330 | 60/40% tin/zinc wire 2mm dia | 12.48 |

6 | Wire | 3096B1340 | 99.995Zn Zinc wire 2mm dia | 5.06 |

7 | Terminal | 5036B9078CET | Terminal Boss | 0.34 |

8 | Terminal | 5036B9078DET | Terminal Boss | 1.35 |

9 | Core | 5096B000415 | Ø9 mm x 41.5 mm winding core 5 mm | 0.01 |

10 | Resin | 2096B1340 | RX701C/BL Epoxy resin blue colour RAL 5017 | 5.25 |

| MaterialID | Type | StockNumber | Material | Cost |

|---|---|---|---|---|

1 | film.. | 7511038-01 | Film mPP 10.8 µm x 37.5 mm DEM 2.5 - High Isotactic | 24.89 |

2 | Foil | 7805018-01 | 5 µm x 18 mm aluminium foil | 41.32 |

3 | film.. | 7508125-01 | Film mPP 7.8 µm x 125 mm SEM 5.0 - High Isotactic | 17.35 |

4 | Solder | 1596B1240 | GS001 500gm 1.6 solder 60/40 KP GR400 | 23.5 |

5 | Wire | 3096B1330 | 60/40% tin/zinc wire 2mm dia | 12.48 |

6 | Wire | 3096B1340 | 99.995Zn Zinc wire 2mm dia | 5.06 |

7 | Terminal | 5036B9078CET | Terminal Boss | 0.34 |

8 | Terminal | 5036B9078DET | Terminal Boss | 1.35 |

9 | Core | 5096B000415 | Ø9 mm x 41.5 mm winding core 5 mm | 0.01 |

10 | Resin | 2096B1340 | RX701C/BL Epoxy resin blue colour RAL 5017 | 5.25 |

| MaterialID | Type | StockNumber | Material | Cost |

|---|---|---|---|---|

1 | film.. | 7511038-01 | Film mPP 10.8 µm x 37.5 mm DEM 2.5 - High Isotactic | 24.89 |

2 | Foil | 7805018-01 | 5 µm x 18 mm aluminium foil | 41.32 |

3 | film.. | 7508125-01 | Film mPP 7.8 µm x 125 mm SEM 5.0 - High Isotactic | 17.35 |

4 | Solder | 1596B1240 | GS001 500gm 1.6 solder 60/40 KP GR400 | 23.5 |

5 | Wire | 3096B1330 | 60/40% tin/zinc wire 2mm dia | 12.48 |

6 | Wire | 3096B1340 | 99.995Zn Zinc wire 2mm dia | 5.06 |

7 | Terminal | 5036B9078CET | Terminal Boss | 0.34 |

8 | Terminal | 5036B9078DET | Terminal Boss | 1.35 |

9 | Core | 5096B000415 | Ø9 mm x 41.5 mm winding core 5 mm | 0.01 |

10 | Resin | 2096B1340 | RX701C/BL Epoxy resin blue colour RAL 5017 | 5.25 |