Hi there,

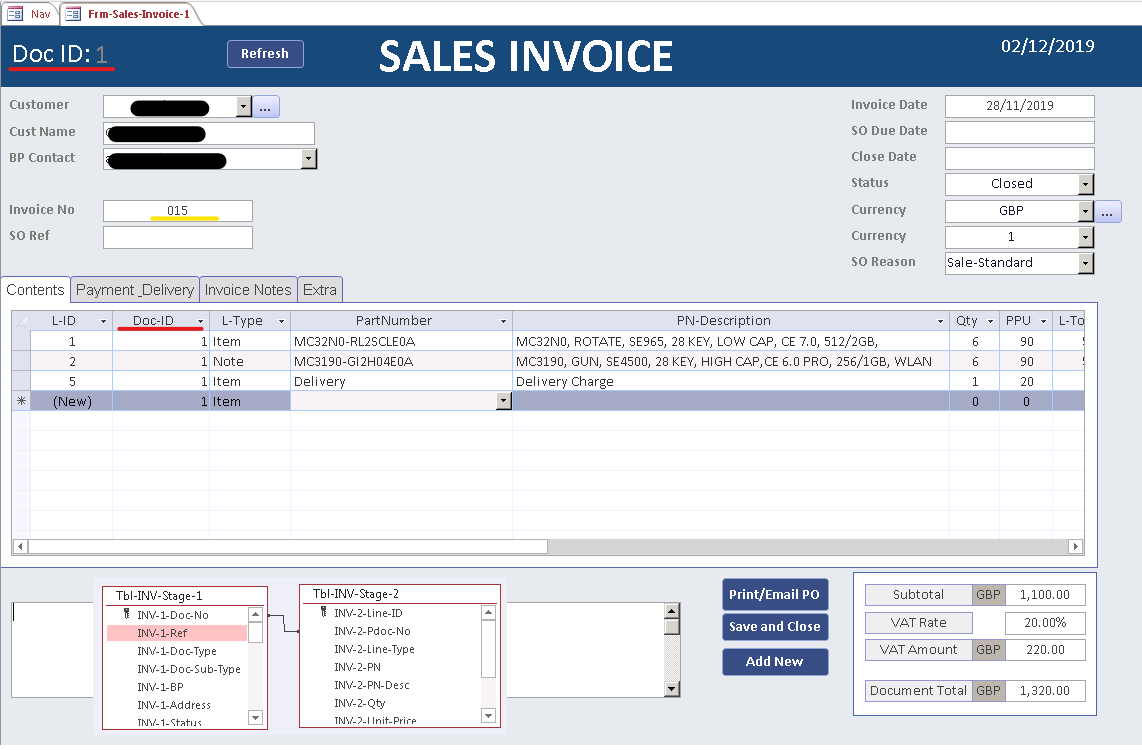

I have a draft form for invoice creation, (i know there shouldnt be '-' in names but this was made a while ago)

Stage-1 main invoice

Stage-2 product details/costs etc

At the moment the autonumbers are the PK's but INV-1-Ref is the actual invoice number

My question is, is there some other relationship or index that i should put in place between the two other than the Autonumber? Or should the autonumber not be the PK? if the record is deleted somehow then i would not be able to relink the missing product records from stage-2 again?

I would like to make sure i get the foundation structure correct as this will be the same/similar structure for Sales Orders, Purchase Orders, Quotations etc

I've attached a screenshot which includes a snip from the relationships as well

I have a draft form for invoice creation, (i know there shouldnt be '-' in names but this was made a while ago)

Stage-1 main invoice

Stage-2 product details/costs etc

At the moment the autonumbers are the PK's but INV-1-Ref is the actual invoice number

My question is, is there some other relationship or index that i should put in place between the two other than the Autonumber? Or should the autonumber not be the PK? if the record is deleted somehow then i would not be able to relink the missing product records from stage-2 again?

I would like to make sure i get the foundation structure correct as this will be the same/similar structure for Sales Orders, Purchase Orders, Quotations etc

I've attached a screenshot which includes a snip from the relationships as well